A private wealth management expert has said he believes that the wealth management industry is “broken.”

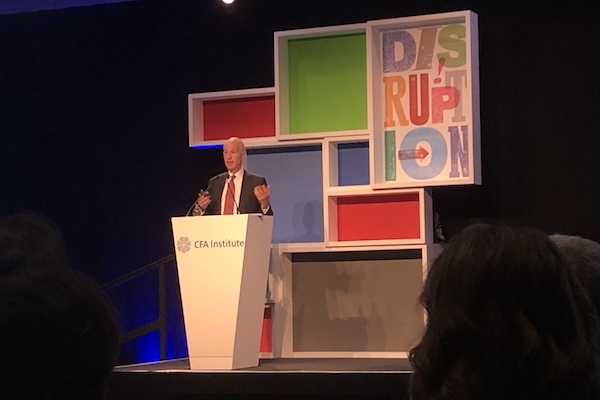

Philip Marcovici, a retired lawyer and now a global wealth management consultant, was addressing delegates at the CFA Institute at London’s ExCel today when he made the claim.

Mr Marcovici was speaking on the broad topic of global private wealth management and highlighted a number of issues he said dogged wealth management.

These included conflicts of interest like retrocessions, or “kickbacks”, opaque charging structures and “corruption”.

He said most of the malpractice took place in Asia, but he also highlighted cases in Switzerland.

He added that, “the wealth planning industry is a broken industry”.

“Asset management is a commodity, what’s not a commodity is excellence in client relationships.

“I view the job of an adviser is one of being honest with clients and helping them to negotiate a complex world,” he said.

He also highlighted the need for better planning within families as the key to avoiding succession and inheritance disputes.

He said: “Not having a succession plan is a succession plan.

“We need to help families understand what is your plan?

“Sometimes doing a fire drill to test it out is the best way.”

Speaking more generally about investments Mr Marcovici said he preferred “transparency” and said he believes the offshore investments are set to diminish.

“You’re going to see a dramatic shift over the next few years away from these offshore centres.

“It isn’t just business as usual.”

He said there would be a growth in on shore investing and in what he termed ‘mid-shore’, which included territories with tax and regulatory infrastructure, like Luxembourg, Singapore and Hong Kong.