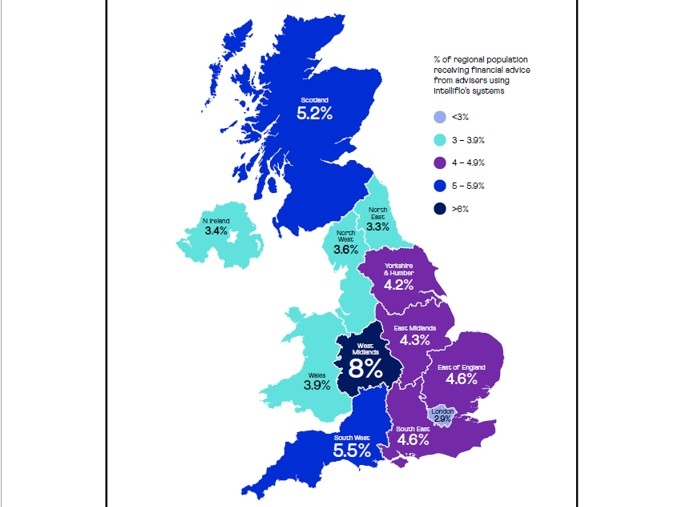

The West Midlands is the region where the greatest proportion of the local population is receiving regulated financial advice, according to new data.

Almost 1 in 10 (8%) of the population of the West Midlands is receiving advice compared to just 2.9% of Londoners, according to analysis by Intelliflo.

Those in the South West (5.5%) and Scotland (5.2%) were the next most likely to be receiving financial advice.

There was also a clear difference when relationship status was analysed.

Two thirds (66%) of those receiving advice are married or in a civil partnership. Less than a quarter (23%) are single or cohabiting, while 6% are divorced and 5% are widowed.

A clear gender gap is also evident.

Intelliflo’s data shows 46% of those receiving regulated financial advice are female and 54% are male.

The North East has the largest gender advice gap, where the split between female and male advised clients is 44% to 56% respectively, whereas London has the narrowest gap of 48% females to 52% males.

Those in their 50s are the most likely to be currently receiving financial advice.

A quarter (25%) of those receiving advice are aged 50-59, those aged 60-69 make up 21% of those advised, and those aged 40-49 make up 16% of those receiving financial advice.

In total some 60% of those receiving advice are over 40. People in their 30s make up 11% of those advised and under 30s just 5%.

Nick Eatock, CEO of intelliflo, said: “Financial advice can make a positive difference to someone’s personal circumstances, especially during challenging economic times. Yet, we can see that engagement with financial advice varies quite considerably, whether that’s a result of where you live, your age or relationship status.”

He added: “We believe we’re facing a massive opportunity for change in 2021 driven by a rapid acceleration in the adoption of technology, which plays a vital part in reducing the cost of onboarding a new client and delivering advice to smaller savers.

“With 60% of advisers reporting better adoption of technology with their clients over the pandemic, I believe this will mark a turning point in the way that people are able to access and engage with financial advisers and receive the professional advice they need on complex financial matters.”

The figures are based on analysis of Intelliflo’s database of 2.12m end clients who paid for financial advice in the last 12 months.