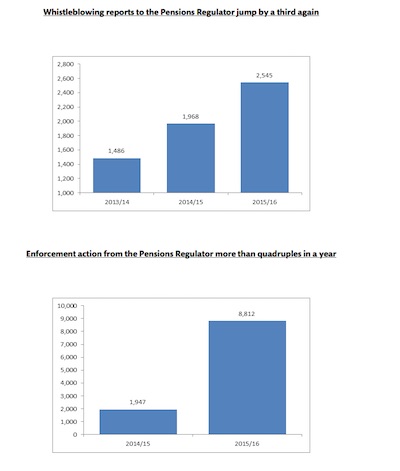

Whistleblowing reports to the Pensions Regulator have risen 29% in a year, according to new analysis.

Data obtained directly from the Pensions Regulator showed that there were 2,545 whistleblowing reports in 2015/16 (ending 31 March) compared to 1,968 the year before. This was excluding statutory reporting of breaches of law under the Pensions Act.

The figures were obtained in a Freedom of Information request by global law firm Clyde & Co.

The number of enforcement actions used against employers has risen from 1,947 in 2014/15 to 8,812 in 2015/16, more than a four-fold increase, the firm’s analysis illustrated.

Failure to comply with the auto-enrolment regulations can lead to fines of up to £10,000 per day, depending on the size of the business. Clyde & Co deals with compliance in its pensions practice that acts for trustees, employees and insurers.

Mark Howard, head of pensions at Clyde & Co, said: "The final stages of the auto-enrolment process are likely to be the most challenging, as there are so many employers that will need to enrol their employees.

"On top of this, the SMEs yet to face their enrolment deadlines are not going to have the support of HR departments to help them deal with the administrative headache of enrolling their employees into a pension scheme.

"The regulator has put out a lot of guidance aimed at SMEs, but even so it is not surprising that we are seeing the number of whistleblowing and enforcement actions increase as the number of employers subject to auto-enrolment grows substantially.

"As many expected the regulator is ramping up its efforts to crack down on non-compliance. Fines handed out should serve as a warning that SMEs need to ensure they plan well in advance to avoid enforcement action.”