Scottish Widows has unveiled four ‘risk-managed’ multi-asset Retirement Portfolio funds aimed at clients considering or taking withdrawals using the Scottish Widows Retirement Account.

The move comes a week after Scottish Widows and Lloyds Banking Group’s Wealth businesses announced they would terminate their partnership with Standard Life Aberdeen which manages over Ј100bn of Scottish Widows and Lloyd’s Bank client funds.

Scottish Widows says the new funds for drawdown are designed to reduce the risk of capital losses for drawdown customers during volatile markets by using a Dynamic Volatility Management (DVM) process that maintains exposure to equity growth opportunities, unless volatility becomes significant, and then exposure is reduced temporarily.

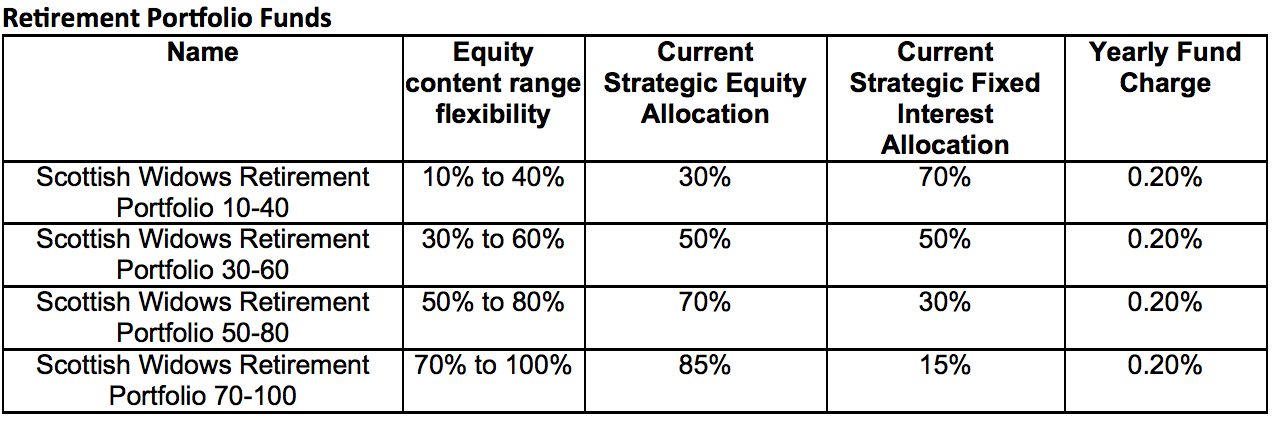

The Strategic Asset Allocation (SAA) of the funds is based on Scottish Widows’ Pension Portfolio funds. They invest in UK and global fixed-interest and equities and use index-tracking investments to help keep costs down. The yearly fund charge is 0.2%.

The DVM mechanism triggers a reduction in equity exposure with the aim of mitigating or offsetting investment losses. When volatility is within acceptable limits, the DVM process retains equity market participation and growth potential, says Widows.

The funds are named to reflect the range of equity investment within each fund’s SAA, which allows Scottish Widows’ a degree of flexibility when assessing how to position the funds. The funds’ different equity ranges mean they could suit a broad spectrum of customer risk appetites, Scottish Widows believes.

Source: Scottish Widows

Iain McGowan, head of fund proposition, Scottish Widows, said: “Since the introduction of Pension Freedoms, an increasing number of customers stay invested during retirement and withdraw money using income drawdown. They need an appropriate investment strategy that balances the potential for investment growth with the desire to mitigate significant losses.

“The Retirement Portfolio Funds recognise customers’ need for real growth to help protect their income and lifestyle from inflation, while balancing that exposure with an appropriate level of investment risk. Our new funds are designed to address both of these requirements, without the need for expensive guarantees or complicated hybrid design.”