The Government would be sending out an anti-saving message if it decides to scrap pension tax breaks for high earners, the Wealth Management Association says.

Through comments this week from Dr Ros Altmann, the new Pensions Minister, it emerged the measure is being considered.

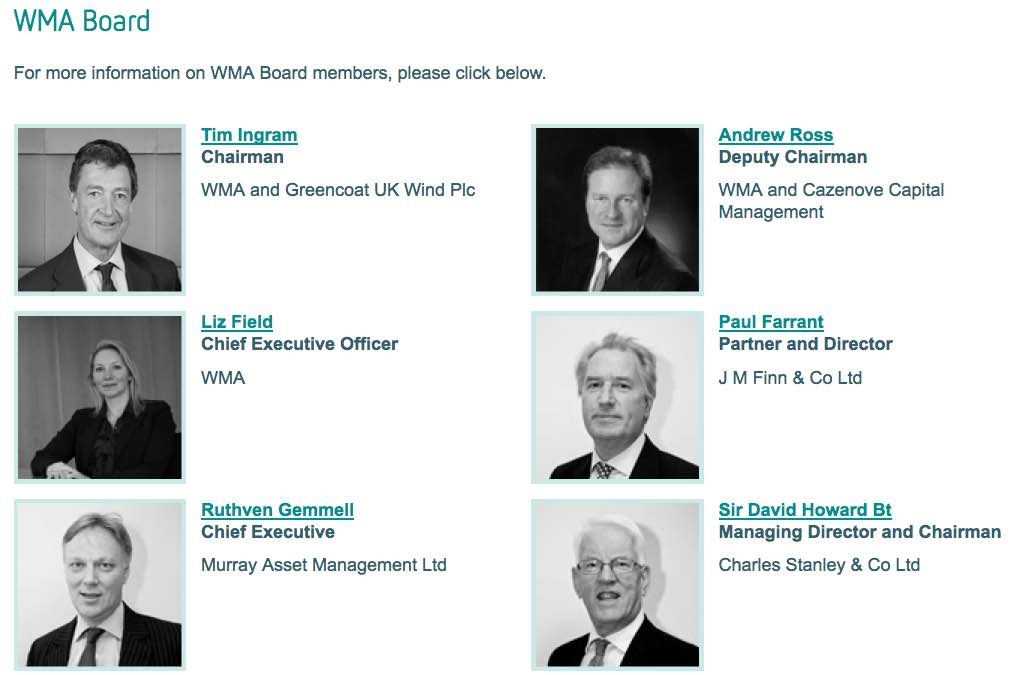

But Liz Field, chief executive of the WMA, warned that it would be a counterproductive move.

She said: “Cutting pensions tax relief sends an anti-saving message whatever guise it is in – whether a person earns £30,000 or £150,000, creeping taxation puts people off investing and saving for retirement and disincentivises those saving less from trying to save more in case they get caught by taxes coming lower and lower down the scale.”

{desktop}{/desktop}{mobile}{/mobile}

She said: “These changes come after the Chancellor’s ‘savings revolution’ in his last Budget just four months ago, and follow his widely publicised and promoted new pensions freedoms. Constant shifts in government treatment of these issues reduce trust in government initiatives and increase the public cynicism with which policy announcements are met.”

“This is counterproductive to significant savings and investment objectives and undermines their impact on jobs, growth, infrastructure development and the ability of people to look after themselves in later life. The changes encourage people to spend their pension money, rather than keeping it for the long term.

“We need a long term government commitment to developing a full-scale investment and savings culture in the UK.”

Julian Webb, head of Fidelity DC and workplace savings at Fidelity Worldwide Investment, called for the review to “not dis-incentivise retirement saving and to properly tackle how tax relief will subsequently be redistributed among low to middle income workers”.

He said: “We believe that the real issue is around how to create a coherent savings policy to encourage higher levels of retirement saving. Any initiative would need to be judged against four key criteria namely: it is inclusive of all workers, provides a clear incentive to save, can be implemented with minimal disruption and is sustainable for the long term.

“While there is debate around keeping higher earners engaged, we need to recognise that, ultimately the nature of how this groups saves for retirement will change. Indeed, it is changing already with a shift to cash benefits.

“Therefore, we hope the review addresses the bigger question which is how we look to redistribute this relief to benefit lower and middle income workers in order to properly incentivise saving for retirement.”