Poor Financial Planning is leaving women at risk in the future, according to HSBC.

The firm’s Future Retirement report surveyed over 17,000 people in 17 different countries.

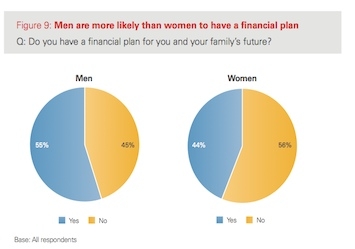

Overall, only 50 per cent of respondents said they had a financial plan for their own or their family’s future.

This number rose among those who were married with children to 58 per cent.

Men were more likely to make a financial plan than women, 54 of men and 62 per cent of married men with children have a financial plan, compared to 44 per cent of women and 55 per cent of married women with children.

Men were also most likely to take sole responsibility for financial decisions in the family. This could potential leave women exposed to financial hardship later in life, especially as over a third rated their financial knowledge as “basic.”

In the UK, 37 per cent of men said they were responsible for financial decisions and 65 per cent of these people said they acted alone.

However, 47 per cent of women said they participated jointly with their partner.

The report stated: “Women claim to feel included in making joint household decisions about the finances, whereas men claim to be making important decisions on their own. This is an interesting insight into people’s perceptions of how financial decisions are made and raises questions about how involved women rally are.”

Men also took responsibility for decisions regarding retirement planning, only 24 per cent of women said they were planning for retirement, even among those in the oldest category of 50-59.

The only area where women did take sole responsibility was for managing the household budget, 37 per cent of women said this was their responsibility.

The most popular ways to make decisions were by speaking to family and friends or doing own financial calculations.

Only 31 per cent of people had consulted a financial adviser and seeked advice from their bank.

The firm says more support is needed to improve financial education and better access to professional advice to encourage women to get their Financial Planning underway.