Research by Santander has highlighted a growing savings gender gap with women savings less than half the amount men have saved.

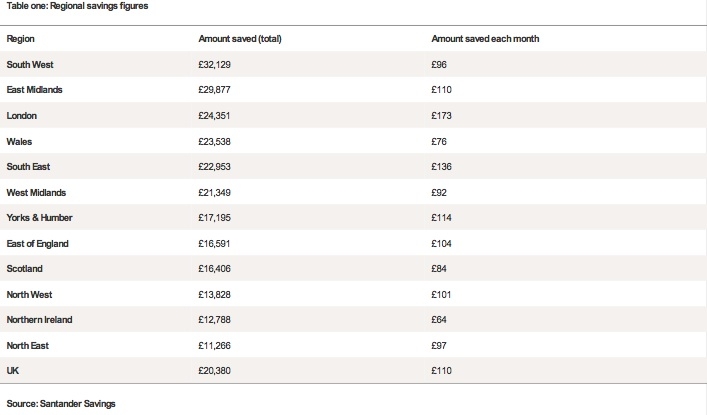

The survey of 2,000 adults found that almost 10 million Britons have no savings at all and the average total savings per UK adult is £20,380 with the average deposited in savings each month £110.

Women's savings habits lagging significantly behind men, according to new figures from Santander Savings. The average Briton has £20,380 held in savings, but this falls to £13,070 for women compared to £28,079 for men. This brings the current savings gender gap in the UK to £15,009.

A comparison with figures from Santander's previous savings research suggest that the savings gender gap is getting bigger. In 2011 men had an average of £24,272 deposited, while women had £16,720 held in savings – a gender gap of just £7,552, which is around half the current figure.

Santander's research revealed that almost 10 million (19 per cent) Britons are without any savings at all, rising to 21 per cent for women and falling to 17 per cent for men. And with more than a third (34 per cent) of those questioned stating they were not depositing any money in savings accounts , the findings raise concerns about the nation's savings habits as a whole, says Santander.

The amount set aside by the average Briton stands at £110 per month but this falls to £87 per month for women compared to £134 per month for men. In 2011, the average amount deposited by women was £98 and by men £132, underlining the long term savings gender divide.

{desktop}{/desktop}{mobile}{/mobile}

A quarter of people say they plan to start saving more over the next three to six months.

Richard Al-Dabbagh, head of savings for Santander, said: "For many people, meeting the cost of everyday living can be a challenge, so the prospect of trying to save at the same time can be daunting. Having that financial safety net to fall back on is vital."

Anna Bowes at independent savings advice site Savingschampion.co.uk: "It's always a concern if people are not putting aside enough or worse still any savings for their future. Although it's not wholly surprising with the cost of living continuing to rise, albeit at a slower pace, it's still essential that everyone puts something aside. In the current low interest rate environment there may be less incentive to save, but people have to think about their future as well as saving up for things they may need in the short term."

Looking regionally, people in the South West have put away almost £12,000 more than the national average at £32,129. At the other end of the spectrum, those in the North East have the lowest amount saved – averaging £11,266. Looking ahead, almost a quarter (24 per cent) of Britons say they plan to increase the amount they are saving within the next three to six months.

Santander also questioned respondents about what they wanted from a savings account and found that access to their money without charge was the most important, cited by 46 per cent. A good rate of return (36 per cent), access to their account online (8 per cent) and good customer service (4 per cent) were also frequently cited. At present in the UK, an instant access savings account is the most popular type of account, held by 61 per cent of people.

Opinium Research surveyed 2000+ adults on behalf of Santander 18 – 21 March 2014.