More women than men are saving money for the first time in a year, according to Legal and General.

The firm’s MoneyMood survey questioned 1,000 adults and found 72 per cent of women were saving compared to 66 per cent of men.

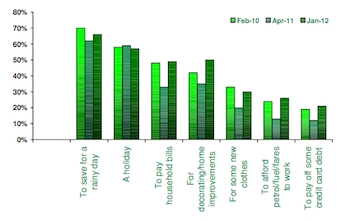

Most people were saving for a rainy day or a holiday but there was a marked increase in the number of people saving for household finances.

This includes decorating, household bills and petrol/public transport fares.

L&G suggested the increase in budgeting and savings for household expenditure was the reason for the higher proportion of female savers.

Higher costs for household finances were not helped by the fact that only seven per cent of people expect their household earnings to rise faster than inflation and only three per cent expect their savings to match inflation.

Householders in the North East, East Anglia and Midlands said they had significantly increased their savings while those in the South were spending more.

Mark Gregory, executive director of savings at L&G, said: “The focus of saving has shown a significant shift to managing the household bills as people continue to struggle against the rising cost of utilities and fuel with little expectation of an increase in income to help soften the blow.

“Budgeting, to meet short term needs or avoid sinking deeper into debt, has become the prime focus of millions of households up and down the country.”