A new artificial intelligence programme named after the genius that cracked the Nazi’s enigma machine has been launched with the promise that it will ‘revolutionise the UK’s advice sector’.

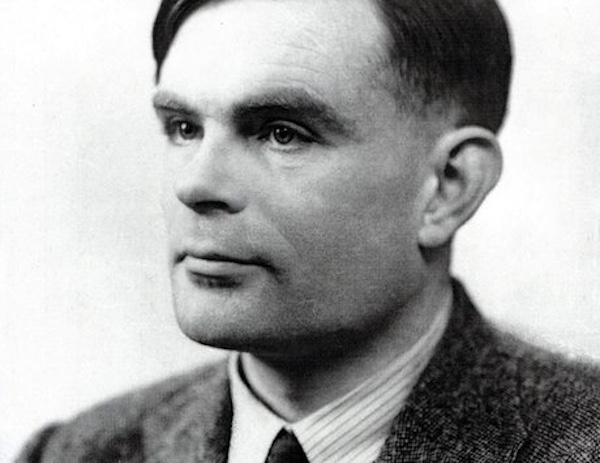

Robo-advice maker Wealth Wizards, which offers a Financial Planning service, has named its new AI service Turo in honour of Alan Turing, the man considered be the father of theoretical computer science and artificial intelligence.

Winston Churchill credited Mr Turing as making the single biggest contribution to the Allied victory in World War Two and his story has been dramatised in the Imitation Game, starring Benedict Cumberbatch.

Wealth Wizards, whose adviser team includes Chartered Financial Planner Michael Hinett, said Turo that will provide access to “faster, cutting-edge robo-advice for the entirety of the advisory sector; from the smallest advisory firm and independent financial adviser to the largest multi-national”.

Wealth Wizards, which has already launched a white-label robo-adviser and robo-Paraplanner tool, said Turo has the ability to “rapidly configure a robo-adviser to match the advice policy of a specific practice or advice brand across advice services”.

A statement from the company said: “Using training data from historic or model compliant cases from the advice firms for the relevant advice service, the AI rapidly configures the software to match the firms existing or desired approach.

“By learning a ‘house view’ in this way, Turo provides two vital services; firstly, it allows the software to deliver massive efficiency by quickly generating a client recommendation for the adviser, and secondly, it can verify recommendations that human advisers have produced.

“The new technology rapidly checks that safe and compliant advice is being delivered enabling anomalies and outliers to be identified and highlighted for further investigation.

“This means that 100% of cases are checked for consistency and appropriateness, while delivering a scalable advice solution. The result is an AI robo-adviser or robo-Paraplanner that is bespoke to the firm and service offered with reduced set-up costs.”

Andrew Firth, chief executive of Wealth Wizards, said it “opens up expert financial advice to many more people by allowing advisers to support a greater volume of cases”.

He said: “In the UK we have a shortage of human advisers, and this technology will allow both small and larger organisations to expand their businesses.”