Sponsored Partner Content from intelliflo:

intelliflo’s 2024 market-wide advice efficiency survey found that over-reliance on manual processes and lack of integration and digitalisation are creating unnecessary errors and extra work for advice professionals. With more firms than ever reassessing their technology to help reduce paper and remove friction, we’ve put together the features we think are crucial for a future-proofed tech stack, writes Johann Koch, Chief Sales Officer, UK & Australia, intelliflo.

Johann Koch of intelliflo

1. Secure online access anywhere

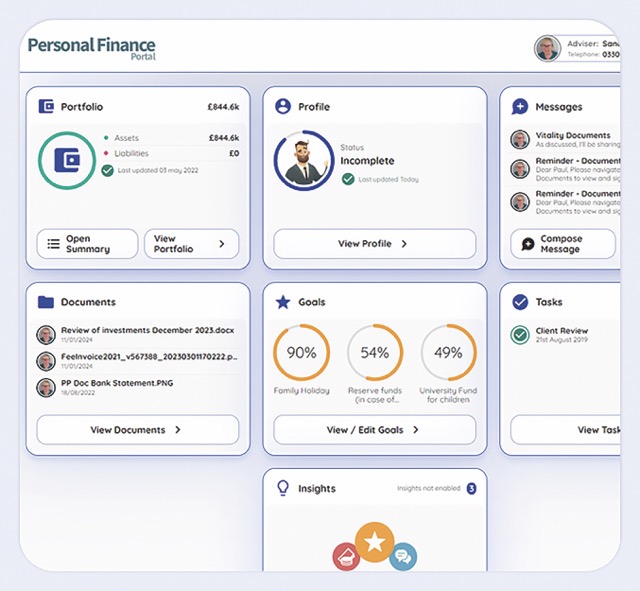

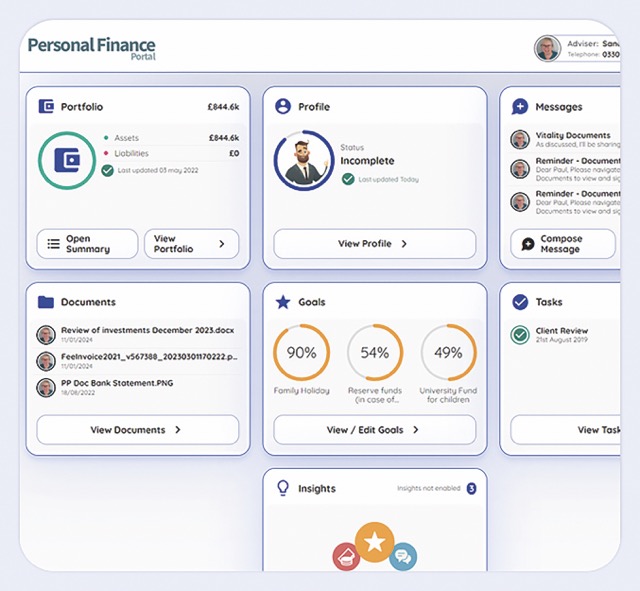

With a ‘Software as a Service’ (SaaS) cloud-based business management system, the correct permissions and an internet connection, your team can access systems securely from any location or device. You can take intelliflo office with you to client meetings and interact with real data during the discussion, updating records as you go to maintain one source of client information ‘truth’.

2. Effective digitalisation

According to our research, only 40% of processes are currently digitised and firms want this to increase to 75%. Onboarding clients was a particular pain point, but using tools integrated with intelliflo office to digitise note taking and extract key information during meetings can free up advisers to focus on the client conversation and provide capacity for further growth.

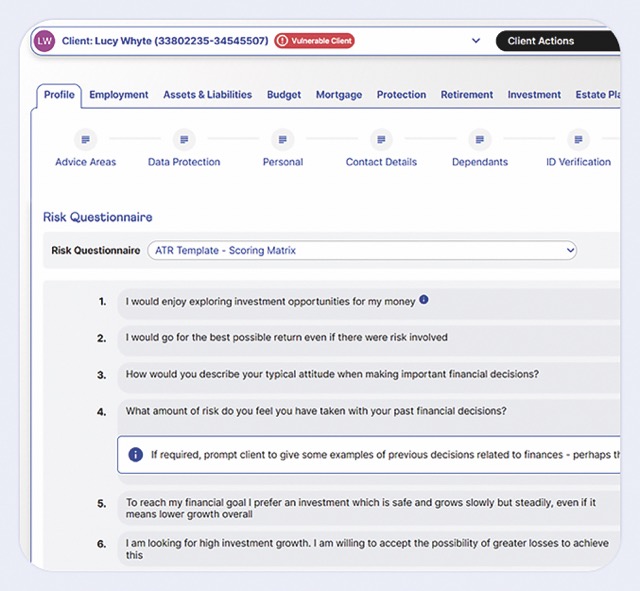

3. Single data entry

Re-entering the same data on different systems is a massive headache for advisers. A staggering 98% of advice firms say rekeying information multiple times during onboarding has led to mistakes in 20% of client cases. A joined-up process, where single data entry accurately populates systems throughout the advice journey, will boost efficiency and reduce stress on the admin team.

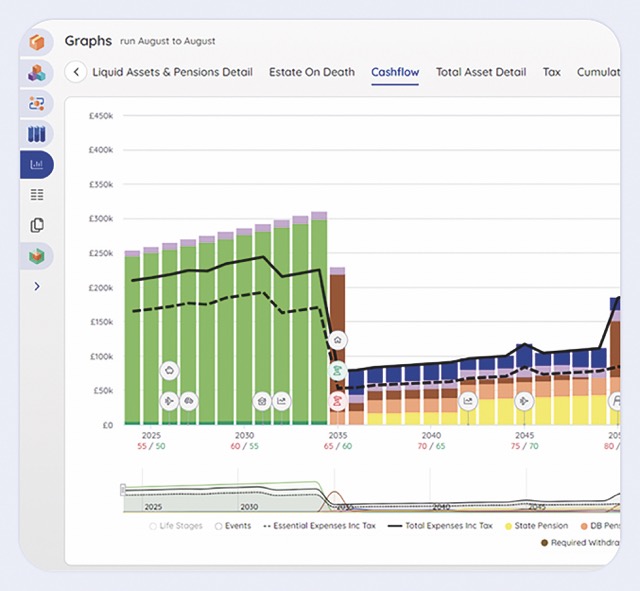

4. Integrated advice journey

In our research, 94% of advisers believe their advice journeys could be more efficient, with lack of integrations a key issue. However, a straight-through process across the entire advice journey, from the initial fact find through to investing and ongoing management, is now attainable with our latest wealthlink innovation. It puts the front end of a retail platform inside intelliflo office, so you can set up and maintain client investments without leaving the intelliflo office environment. The US launch of wealthlink saw submission errors fall from 50% to 1%, thanks to intelligent data collection and removal of paper forms.

5. Workflows to support accurate dat

Making better use of data is vital to creating the personalised experience that clients value, helping drive engagement and retention. But when data is inaccurate or stored on different systems, it’s hard to extract insight or open it up via a secure client portal. Having workflows that encourage accurate first-time data entry and highlight missing information for advisers or clients to update delivers efficiencies in the advice process and ensures planning is based on a full and accurate picture of the individual’s financial position.

6. Appropriate artificial intelligence

AI is becoming viewed as a transformative force, but while almost three-quarters (72%) of advice firms want to integrate it into advice delivery, 95% feel their business lacks the skills to do so. Tools need to be suitable for the highly regulated world in which we operate and carefully integrated into the financial advice workflow, so we’re adding a growing number of capabilities and solutions to intelliflo office and the intelliflo store to help you seize the opportunities AI offers.

At intelliflo, we continue to work on streamlining the advice process. Our powerful cloud-based business management solution, intelliflo office, sits at the heart of over 2,500 financial advisory firms. It offers an adaptable, scalable solution, digitised processes and a huge range of partner integrations to create efficiencies, support growth and encourage client engagement.

Screenshots from intelliflo office

intelliflo widens access to financial advice through leading technology which powers the financial advisory experience. We use open software architectures combined with unmatched industry experience to simplify a complex digital landscape to help advisors compete and grow. Our solutions support over 30,000 financial advisors worldwide, representing over three million end-investors, with over $1 trillion advised across our platforms.

Website: https://www.intelliflo.com/ Email address: