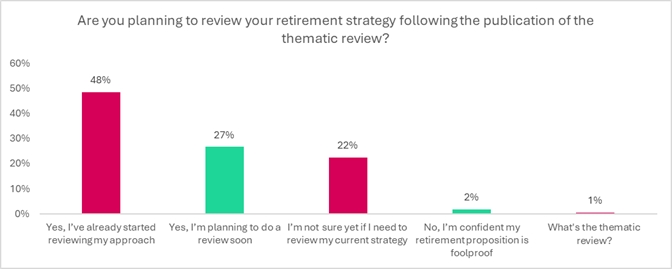

Three quarters (75%) of financial advisers are reviewing their retirement approach following the FCA’s thematic review of retirement income advice.

Just 2% are confident that their retirement proposition does not need to change, according to a poll of financial advisers by platform Wealthtime and DFM Copia Capital.

The research found that almost half (48%) have already started a review, while a quarter (27%) are planning to do so soon.

A quarter (23%) of advisers said they were not sure yet if they needed to review their current strategy.

The research looked at how the advice profession constructs retirement propositions and whether these approaches need to evolve in light of Consumer Duty and the FCA’s thematic review.

Robert Vaudry, head of commercial at Wealthtime, said, “The thematic review has hit home among advisers. Most firms are sitting up and taking notice of the FCA’s findings, realising that their existing retirement propositions might not meet the regulator’s expected standards.”

He pointed out that planning for retirement has never offered so many options, but has also never been so complex.

That means Financial Planners and advisers need to determine not only how a client will finance their transition from wealth accumulation to decumulation, but also the appropriate level of income to draw out and the best investment strategy for the remaining invested funds to mitigate the specific risks faced in retirement.

He said: “It’s reassuring that the profession is already working to assess their retirement income advice processes and make sure they meet and evidence the FCA’s requirements and will deliver the best outcomes for clients.”

Private equity firm AnaCap Financial Partners owns Wealthtime, Wealthtime Select, and Copia Capital. Combined, the platforms have more than £11.3bn of pension and investment assets under administration (AUA) and more than 76,000 clients (as at January 2024). AUA is split £8.85bn and £2.45bn, Wealthtime and Wealthtime Select respectively.

Copia Capital is the discretionary fund management part of the group that works exclusively with advisers to provide a range of managed portfolio services.

• The survey of 165 financial advisers, took place at the Copia and Wealthtime rethinking retirement roadshows in April and May.