The advice sector has been told today its bill to help pay for the FCA will rise by 4.7%.

The regulator published its business plan for the year ahead this morning and proposed the category A13, including financial advisers, should have increased fees of £77.1 million. This is an increase on the £73.7 million paid last year.

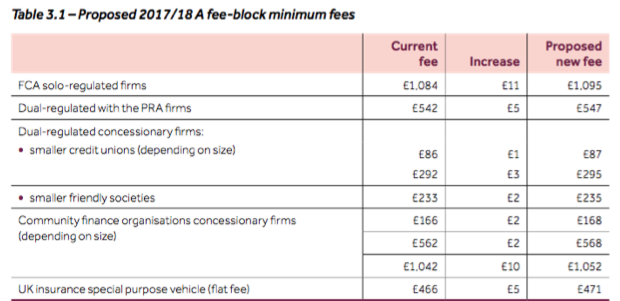

See tables beneath.

But due to the fact that the estimated number of firms in this fee block will rise to 9,779, from 9,501 last year, individual companies could pay less. The FCA expects a 2.9% in firms falling into this category.

The overall annual funding requirement for 2017/18 will rise by nearly £8m to £526.9 million. This includes £2.5 million for costs associated with Brexit. Last year’s annual funding requirement was £519.3m.

The minimum fee for small firms is set to rise by 1% - equating to £11 - to £1,095.

The FCA report stated: “We are proposing to increase the 2017/18 minimum and flat fees by 1% to reflect the inflation increase in our ongoing regulatory activities (ORA). We are also proposing to link minimum fees and flat fees to future movements in our ORA. Such a link will mean that the level of minimum fees and flat fees will reflect increases in our costs over time rather than only variable fee-payers picking up these increased costs (or any decreases in our costs, if applicable).”

Below: FCA tables showing fee allocations