Advisers’ bill for running the FCA to drop from £74.9m

The total fees that advisers will have to pay the FCA next year will fall, it was confirmed this morning.

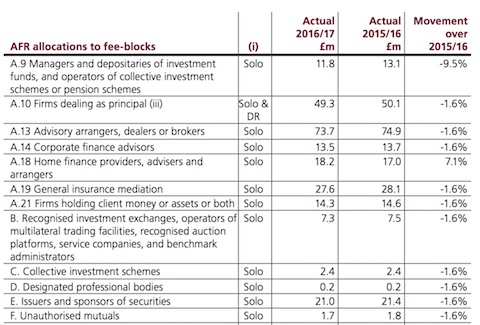

The A13 block of financial professionals, including advice firms, are set to pay 1.6% less, that is £73.7m, against the £74.9m paid in 2015/16.

The fees were originally announced in April and then put to consultation. The final outcome was published today.

Regulatory news

Exclusive: New FCA website cost revealed as £536,000

Corporate finance advisers, falling into the A14 block, also get a 1.6% decrease, going from £13.7m to £13.5m.

The FCA has said it would hand the A13 fee block a £4.2 million rebate on its 2016/17 fees from fines levied against firms in that funding block.

Pension Wise funding allocations were also confirmed.

The adviser category will pay £2.7m or 12%. This puts the A13 block (Advisory arrangers, dealers or brokers) below the other five categories who will be paying into the guidance funding.

The FCA said it received one response from a trade body representing financial advisers which commented that the allocation of the Pension Wise funding requirement to the A13, which includes their members, should be 5%.

But officials said they were sticking with the 12% figure.

The FCA report stated: “For 2015/16 we reduced the allocation to A13 by 50% to 12% in recognition that financial advisers only benefit from the pension flexibilities and Pension Wise if consumers seek regulated advice. The A13 fee-block contains a very diverse spread of types of firms.

“These include banks, insurance companies, securities brokers who act for retail clients and wholesale market brokers as well as financial advisers. We estimate that around 3,108 financial advisers, whose main business is to provide advice on retail investment products, will contribute £270,000 (10%) of the £2.7m Pension Wise funding requirement allocated to the A13 fee- block.

“This means that these firms contribute 1.2% of the total £22.5m Pension Wise funding requirement. The £270,000 contribution represents 0.01% of the £2.8bn income these firms repost for fees calculation purposes.”