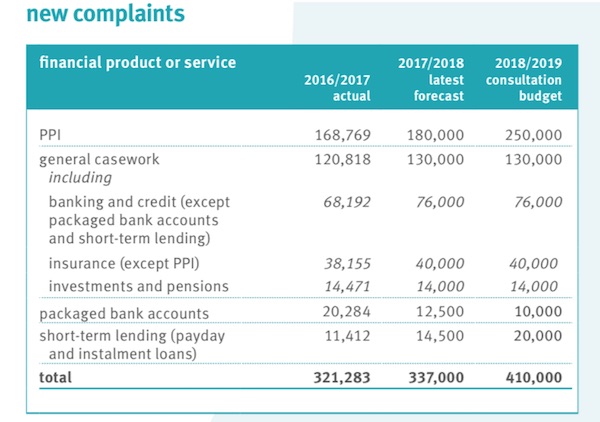

In a 2018/19 budget consultation paper released today the Financial Ombudsman Service (FOS) has warned that it is expecting to receive more complaints than the budget it has available to deal with them.

Based on demand, the Ombudsman said in its consultation paper that its total operating income will be £230.7m next year but total expenditure is expected to be £293.1m, a difference of over £60m.

Despite budget constraints the financial regulatory body said it will continue to charge a case fee of £500 per case with 25 “free” cases.

A rise in complaints has been seen by the Ombudsman, especially annuity complaints which have seen a significant rise over the last few months although exact figures were not supplied in the report.

The report said: “Many of the people involved tell us they believe they should have been sold an enhanced annuity, because of their illness or lifestyle.”

Keeping costs under control is proving an issue for the Ombudsman as it revealed, “some of our costs have been pushed into the future – for example, the cost of using extra contractor staff to help us flexibly manage an anticipated increase in complaints.

“This is because lower contractor costs together with the release of the contingency budget means that we expect to end the current financial year having spent slightly less than we’d anticipated,” it said.

The reduced budget was also attributed to the change of the FCA’s Plevin rules and guidance implementation date from March 2017 to August 2017, which “delayed progress” as the Ombudsman did not draw on reserves as significantly as planned, said the Ombudsman.

“However, we’ll do so heavily in the next financial year – in line with our long-term plans for managing and then winding down our PPI work, as we’ve explained in previous years.”

The Ombudsman plans to introduce a new funding model as its current strategy of freezing the levy and keeping case fees at the same level for six years is not sustainable, it said.

However, the year 2018/2019 is not the year they will make any changes, “but to ensure we’re ready for when the time is right, we’ll continue to model different options for our funding, and keep talking to our stakeholders as we do so,” said the Ombudsman.

The lack of budget does not help the fact that this year there is an anticipated increase in operating costs by around 14%, said the Ombudsman. The costs are related to additional expenditure on contractor staff.

Complaints about investments and pensions have fluctuated but remain relatively low at 14,000 for the year 2017/2018 and are forecast to remain at that level for 2018/2019.

However, many complaints have been filed on pension freedoms issues (14,000) as some people have been disappointed that they cannot sell their annuity and take up a different arrangement.

“Overall, though, we’ve received relatively few complaints resulting from the pension freedoms – with most of the 1,000 or so we’ve seen relating to administration errors, delays and exit fees.”