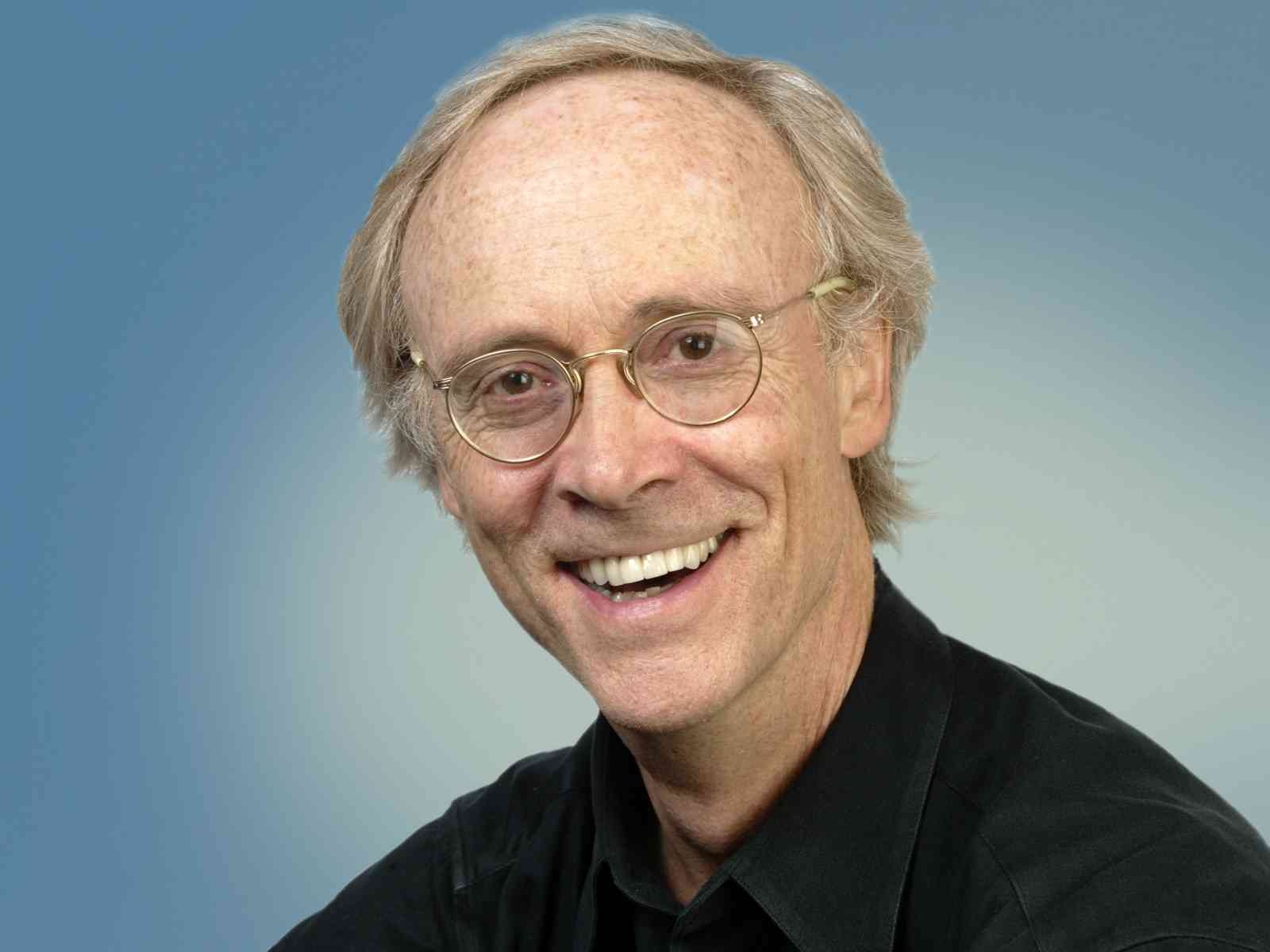

The George Kinder Column

My new book, due out in the spring, is about a golden civilization. A civilization that thrives with freedom for all, for hundreds, if not thousands of years.

It seems that my last column about Lifetime Cashflow Planning has provoked some interesting debate.

Just over a month ago the country voted in the EU referendum - 72.2% of us at least. The result was that slightly more of us wanted out of the EU than wanted to remain.

One of the biggest topics of discussion within the Paraplanning community has been the idea of a Paraplanning Standard.

As I write this, I wonder if I’m about to embark on an article regarding a delicate subject.

The big story in planning circles so far this month seems to have been the acquisition of AXA’s Elevate Wrap by Standard Life.

News this week that the FCA has launched a campaign to protect the over-55s from financial fraud will probably have been ignored by most Financial Planners and Paraplanners. At the very best it will have received token interest. That’s a shame and that needs to change. Financial fraud is everyone’s problem and planners have a role to play in tackling it.

I’ve recently been reading Chris Budd’s excellent book about financial wellbeing (www.financialwell-being.co.uk). His key principle is ‘know thy self’ which means understanding what’s really important to you. To me, it makes sense that the way you invest money should reflect your values.

A lot of nonsense has already been written about Brexit today. I don’t plan to add to it.

Paraplanners have had an important role in financial services for a long time now. From what I've seen, references to Paraplanners have been made for around 20 years - back when they were a lonely, almost unknown role.