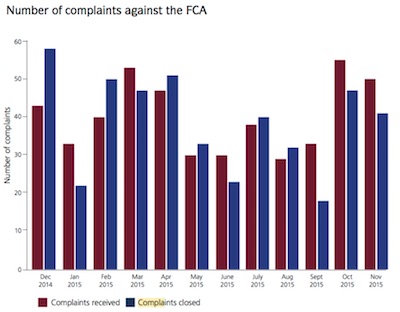

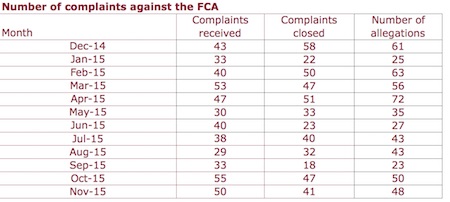

Complaints against the FCA spiked towards the end of 2015, bringing the total over 12 months to nearly 500.

The regulator received 55 in October and 50 in November under its Complaints Scheme, following 33 in September and 28 in August.

Between 1 December 2014 and 30 November 2015 491 complaints were made to the FCA, according to the data, released this morning.

The number of complaints received has remained ‘steady’, officials stated, with 246 received between 1 December 2014 and 31 May 2015 and 245 between 1 June and 30 November.

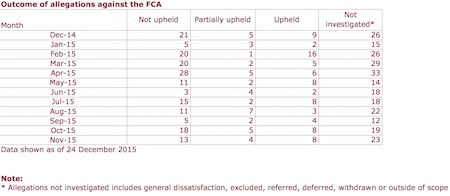

The FCA report stated: “Each complaint received can contain multiple allegations against the FCA.

“So far this year of the 546 allegations closed we did not investigate 47% of allegations against us.

“This can be for a variety of reasons, including that the complaint is a general expression of dis-satisfaction where no misconduct has been alleged, or that the allegations are excluded, referred, deferred or outside of our scope.

“291 allegations were investigated by the FCA, 58% were not upheld and 42% were upheld in whole or in part.”

The figures have been released as “part of our focus to be a transparent regulator”, the FCA said.

The Financial Services Act 2012 requires the FCA, the Prudential Regulation Authority and the Bank of England to have arrangements for the investigation of complaints against them. These arrangements are known as the Complaints Scheme.