New figures from the FCA reveal that over 2,000 new fintech firms have applied for support since its Innovation Hub was opened in 2014.

The Innovation Hub and FCA Regulatory Sandbox were launched to encourage fintech start ups to seek FCA advice and support at an early stage.

The FCA says that as a result of the growth in applications the fintech sector is no longer a niche but a key part of financial services.

Data from the FCA reveals:

• Over 2,000 fintech applications for support since 2014

• Over 800 firms have been supported by the FCA and other bodies

• Over 150 firms have been accepted for testing in the Regulatory Sandbox

The FCA's Regulatory Sandbox allows firms to try out ideas in a secure space with FCA support without risking regulatory intervention, prior to rolling out business propositions to the wider world.

The FCA plans to do more to share data from the growing fintech sector and to encourage more fintech firms to come forward.

It said: “We want to hear from innovative businesses across all sectors, whether they fit into existing categories or whether they are doing something the market has not seen before.”

The FCA added: “The Innovation Hub has been helping firms to develop innovative products and services since launching in 2014. During this period, due to the number of firms we have supported and engaged with, we have gathered a considerable quantity of data and insights into the growing fintech market in the UK.”

In its update on the sector, the FCA quotes The Kalifa Review of UK FinTech which stated: “Fintech is not a niche within financial services. Nor is it a sub-sector. It is a permanent, technological revolution, that is changing the way we do finance.”

Among the firms supported by the FCA are examples across all financial sectors, including firms that provide financial services and firms that help other firms to provide regulated activities.

Data from the FCA showed that for the Innovation Pathways from 2014 to 2021, most firms operated in the retail investments, retail banking and payments and retail lending sectors.

The retail investments sector represented between 20% to 43% of firms each year. In 2020, during the Coronavirus (Covid-19) pandemic, the FCA saw a rise in the proportion of firms in the retail banking and payments sector, as consumers and firms sought “innovative” ways of making and receiving payments when restrictions on people’s movements were in place.

There were also more firms providing products or services that are not specific to one sector, such as firms providing software or RegTech solutions to financial services providers.

Across all cohorts, most Regulatory Sandbox firms operated in the retail banking and payments sector.

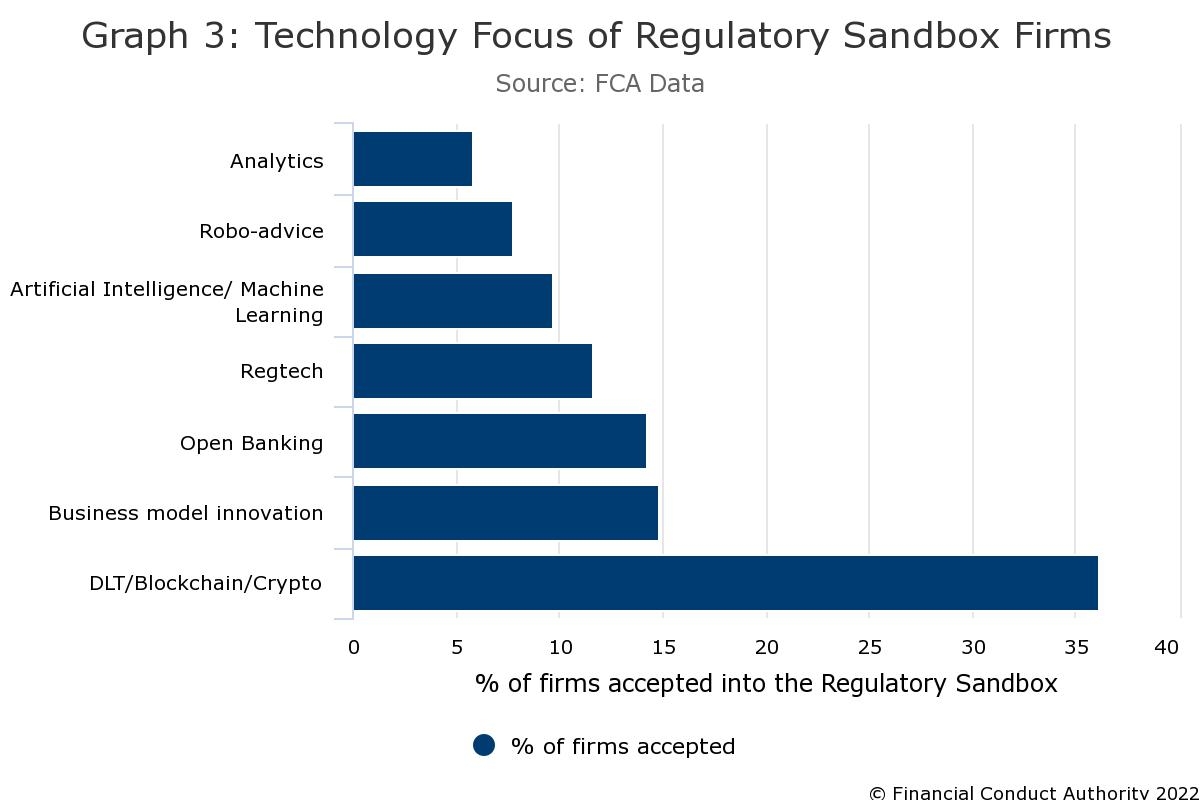

Most business models accepted into the Regulatory Sandbox since 2016 were focussed on distributed ledger technology (DLT), blockchain and crypto assets. Around 15% of firms accepted into the Sandbox had non-technology driven innovative business models and 14% of firms used Open Banking. Also supported were a number of firms using RegTech and artificial intelligence/machine learning to test within the Sandbox.

Most of the firms supported by the FCA were unregulated at the point of applying and 84% of firms that applied were start-ups that are not currently carrying out any business activities. Many of the firms go on to become authorised.

In terms of location, London is the globally recognised hub for fintech, the FCA said, but there were many applications from overseas firms who want to expand into the UK. Most of the firms supported were based in the UK, with 54% based in London and 37% across the rest of the UK. The Innovation Pathways has supported firms around the world across Europe, North America and South America.