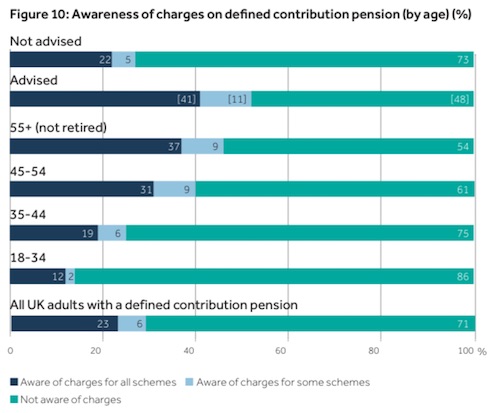

The FCA has found that more than seven in ten adults fail to realise there are any charges levied on their pensions.

Some 71% of those the regulator surveyed with a defined contribution scheme are not aware of any charges on their pension.

For those aged 35-44, this was even higher, at 75%.

This figure fell to 61% for 45-54 year olds with a DC pension. See full table below.

A significant proportion [48%] of those who have taken advice in the last 12 months also do not have awareness of any charges on their pension.

The findings were reported in the FCA’s latest data bulletin on pensions.

Half (49%) of UK adults with a defined contribution pension reported that they did not choose where their contributions were invested when they joined or set up their defined contributions pension.

Only 16% selected where their contributions were invested themselves and 22% actively opted into the default fund.

A significant portion (14%) failed to know whether or not they chose where their contributions were invested, reflecting the low levels of engagement with defined contribution pensions, the report stated.

Table below courtesy of FCA Data Bulletin