The FCA has imposed sweeping restrictions on Beaufort Securities Limited (BSL) and Beaufort Asset Clearing Services Limited (BACSL) and is working with the US Department of Justice to investigate the firms.

Both firms have been placed into insolvency following an urgent application by the FCA to the High Court.

The FCA is working with the US DoJ which is investigating BSL’s “involvement in securities fraud related to stock of various US publicly-traded companies and international money laundering associated with that conduct. “

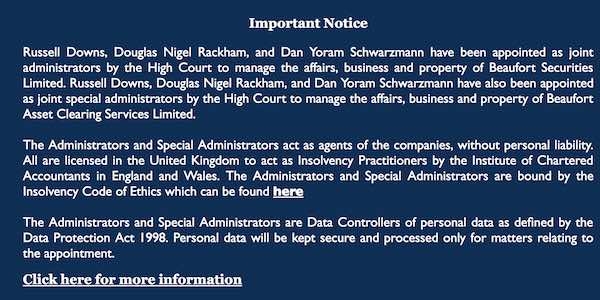

Following an urgent application by the FCA today, the High Court has appointed Russell Downs, Douglas Nigel Rackham and Dan Yoram Schwarzmann of PricewaterhouseCoopers as joint administrators of BSL and joint special administrators of BACSL.

The FCA says it took this action following an assessment of the financial positions of BSL and BACSL which led the FCA to believe that both firms are “insolvent.”

In a statement the FCA said: “This action is also necessary due to concerns that the firms may be involved in financial crime.”

The US DOJ created an indictment yesterday in which BSL, in addition to other companies and individuals, has been charged with securities fraud and money laundering violations.

The UK regulator has ordered the firms to cease all regulatory activity and not to dispose of any firm or client assets without the FCA’s consent.

The FCA is conducting an investigation into the affairs of both firms and the actions have been taken to protect UK consumers, it says.

Under the requirements imposed by the FCA on 1 March 2018:

· The firms must cease to carry on any regulated activity and any business activity that is carried on in connection with a regulated activity

· The firms must not dispose of, deal with or diminish the value of any of their assets (whether in the United Kingdom or elsewhere) without the prior consent of the FCA; and

· The firms are subject to an assets requirement over all the client money and safe custody assets they hold for clients with no provision for anything other than to settle unclosed trades.

The firms must also take appropriate steps to inform their clients they will no longer be able to conduct any regulated activities.

• Customers of the firms who require more information, can visit the PwC website or call the helpline UK: 0800 063 9283 or International: +44 (0)20 7293 0227.