The chair of the FCA has promised to act upon the independent review of how the regulator handled the collapse of London Capital and Finance.

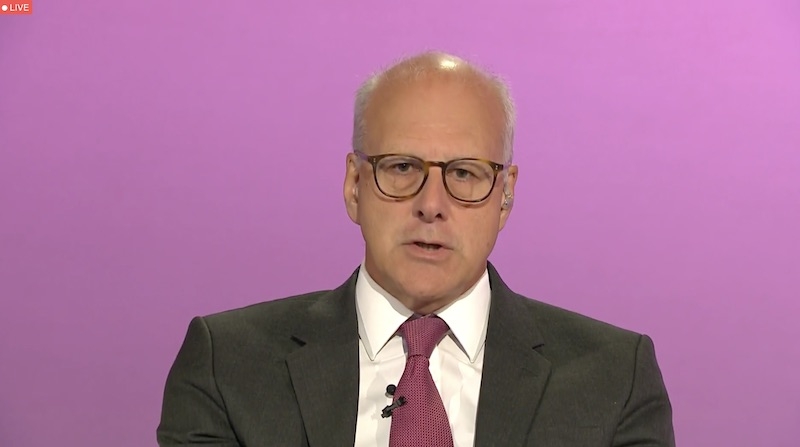

At the annual public meeting of the FCA, chair Charles Randell told the meeting that mini-bond investors want is action.

He said: “What you want from me is not sympathy, you want action. That is why, when we were establishing the facts, I asked the Treasury to take the necessary steps to put in motion an independent review into what had happened.”

The review of how the regulator handled the collapse of the mini-bond provider is nearing its end and Mr Randell said the findings would be published “in the coming months.”

Mr Randell added that he expects the review of give the FCA “some very difficult food for thought.”

At the meeting, Mr Randell also told attendees of his frustration of the “unprecedented challenges” to regulators posed by the Coronavirus pandemic and how it diverted many of the FCA’s resources, meaning some projects had to be pushed back.

He shared his frustration that “many of the resources we had planned for our change programme have had to be diverted to our Coronavirus pandemic response and the uncertainty of leaving the EU."

As part of the regulator’s approach to Brexit, the FCA has launched a consultation on its approach to the regulation of international firms operating in the UK. The consultation will focus on firms that have applied, or intend to apply, for authorisation in the UK as well as those already authorised. This includes those entering the Temporary Permissions Regime.

At the start of this week, interim FCA CEO Christopher Woolard urged the UK to seek a new regulatory model as it faces up to some “painful lessons.”

He said: “In the autumn, we will see the results of a number of reviews into potential failures of the regulatory system. I have no doubt there will be painful lessons and the FCA will need to learn from them.”

Mr Woolard, soon to leave the regulator to carry out a review of regulation, said the FCA was at a regulatory “cross-roads” and needed to build a new regulation model.