The FCA has published an impact assessment highlighting what it believes will happen in the event of different Brexit scenarios.

The regulator says that as a public body it “takes no position on the UK’s withdrawal from the European Union as such” and does not “advocate a particular approach to withdrawal.”

The watchdog did say, however, that it would view the potential outcomes “strictly through the lens of achieving our strategic objective to ensure that relevant markets function well, and our specific operational objectives - to protect consumers, enhance market integrity and promote competition.”

In the event of a ‘no-deal’ Brexit the FCA said: “In a financial services context, this means defaulting to a ‘third country’ relationship, with market access determined under World Trade Organisation (WTO) rules and EU or national member state rules.

“EU legislation would cease to apply in the UK.”

It added: “In the event the UK leaves the EU with no agreement, it will be crucial that all the relevant statutory instruments intended to be laid by Government are in place by exit.

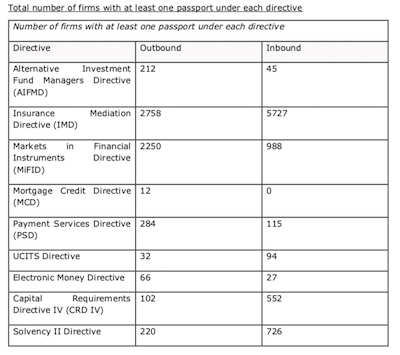

“The UK and EU would become third countries from the other’s perspective, which means passporting rights would cease to apply.

“The UK would no longer be part of the EU legal frameworks that provide for supervisory cooperation and data sharing between member states.”

The scenario also suggested market fragmentation and increased cross-border risk could be heightened and consumers could be affected “as a result of wider economic or market disruption.”

(Source: FCA)

In the event that Prime Minister Theresa May’s Withdrawal Agreement is ratified the report read: “The FCA has consistently supported an implementation period to avoid cliff-edge risks and smooth the UK’s transition to a new relationship with the EU.

“The draft Withdrawal Agreement achieves this by ensuring that EU law, and rights and obligations derived from EU law, continue to apply throughout the period.

“This includes new EU laws that are agreed and implemented during that period.”

But it said that despite this, during the implementation period, the UK will no longer be part of EU decision-making structures, nor will it be represented in the EU institutions.

It added: “The FCA will therefore no longer be a voting member of the European Securities and Markets Authority (ESMA).”