FCA chief executive Andrew Bailey says the regulator will provide technical support to the government on Brexit as the FCA gears up to ensure as smooth a transition as possible to a post-EU financial sector.

Speaking today in London, he said there was no Brexit hesitation at the regulator which was ready to “roll our sleeves up” to get on with Brexit planning, particularly the repeal legislation which is likely to be time consuming and costly, he said. The work has already resulted in an increased FCA levy and rewriting EU directives “line by line” would mean extra costs.

He said: “In terms of our workload, the legislation is the most significant task, involving a line-by-line analysis of each piece of EU legislation and rulemaking for which the FCA is the lead regulator.

“Our objective in this work is, with Government, to create a clear and functioning regulatory regime on the day that the UK ceases to be a member of the EU, and thus to give certainty to all interested parties. In doing so, we will continue to advance our statutory objectives and thus maintain high conduct standards and robust, proportionate and sustainable regulation.

“As we have set out in our budget for this year - while we have sought to absorb as much as possible of the additional cost of putting Brexit into effect by re-prioritising within our established budget - we have levied an additional sum to cover the unavoidable extra costs of the resources needed, largely attached to the Repeal legislation work.”

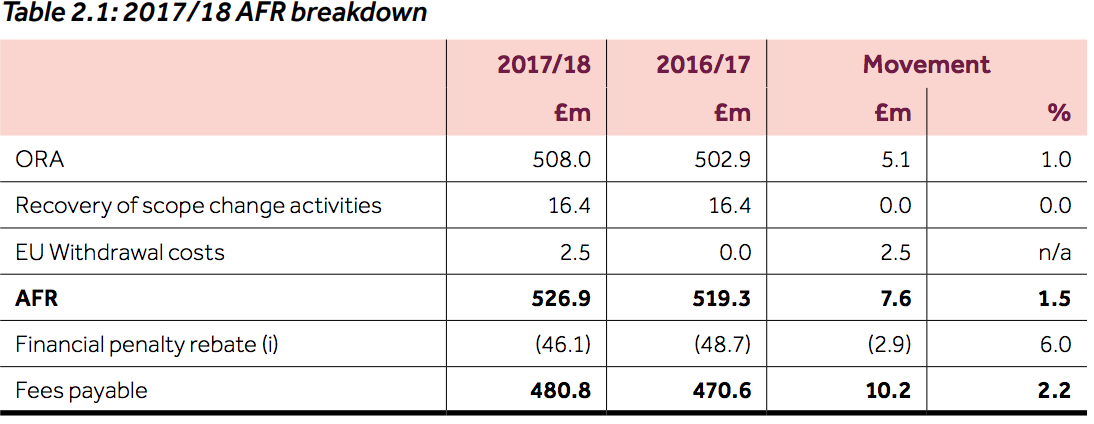

In the FCA’s Policy Statement PS17/15 release this month, the FCA says that the initial levy for ‘EU Withdrawal costs’ will be £2.5m in 2017/18. This is a relatively small part of the FCA’s overall budget for the year of £480.8m however the regulator is keeping open the option to use a £10m reserve fund for ongoing EU withdrawal costs if they rise.

Speaking at Thomson Reuters today, Mr Bailey added: “We are ready to provide whatever technical advice is needed to support the Government in the negotiations ahead. Second, we are working with authorised firms to understand their plans for the future of their cross-border operations into the EU, and from the EU to the UK. Third, we are working with the Government on the Repeal legislation.

Mr Bailey said a key area for focus is investment services, shortly to be governed by a new framework under MiFID II and MIFIR.

Here a firm from outside the European Economic Area (EEA) will be able to provide cross-border services from outside the EU to professional clients and eligible counterparties within the EU without the need to establish in relevant EEA jurisdictions, provided that the regulatory regime of the other state is deemed to be equivalent and in some respects reciprocity exists. For retail clients, there is some scope to require establishment in some form (including branches), which is a sensible recognition of the wholesale-retail difference, he said.

Mr Bailey said that even though the UK was leaving the EU it made good sense to ensure a global, well regulated marketplace was maintained and also that good relations were kept with the EU and its regulators, hinting that post-EU FCA rules may not be so different to EU directives.

“We also need to preserve close regulatory and supervisory links with the EU. Looking ahead, strong co-ordination is a sensible approach to take in order to demonstrate the strength of the system. What are the key elements of such co-ordination?

“I would point to four permanent features: comparability of rules, but not exact mirroring; supervisory co-ordination; exchange of information; and a mechanism to deal with differences. I would add to this the importance of transitional arrangements being put in place which allow for a smooth path to the new post-Brexit world.

“Although the Repeal legislation changes the legal basis for important parts of our framework, it does not change our objectives.”