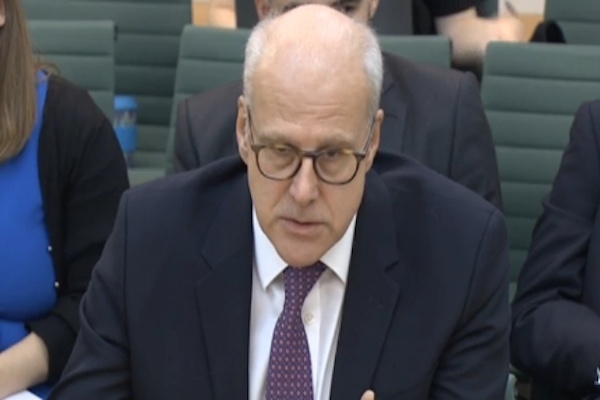

Charles Randell, chair of the Financial Conduct Authority (FCA), has warned regulated businesses of the dangers of dabbling in digital tokens such as cryptocurrency.

In a speech to the Cambridge International Symposium on Economic Crime this week, Mr Randell reminded FCA authorised firms that it was essential they can show how they have addressed the risks that unregulated activities in relation to digital tokens can pose to firms, “both their conduct, and their prudential soundness.”

The FCA has a limited role in registering UK-based cryptoasset exchanges for anti-money laundering purposes.

The regulator has published a list of unregistered crypto exchanges that it suspects are operating in the UK, to help consumers avoid using them.

Where digital tokens are used to constitute or represent investments that the regulator already regulates, like shares and bonds, it addresses them in the same way as for investments that are not tokenised.

There is currently a debate about whether regulators need to regulate cryptocurrencies.

Mr Randall warned that if cryptocurrency is regulated it could give them a “halo effect” that creates “unrealistic expectations of consumer protection” and that he believes that cryptocurrency should continue to be one of many speculative activities that the FCA does not regulate.

He said: “We are not going to award FCA registration or authorisation to businesses which won’t explain basic issues, such as who is responsible for key functions or how they are organised. That would be token regulation in the worst sense.”

However, he expressed hope that digital tokens might become useful to improve the payments market and as security tokens to represent regulated investments.

Security tokens could be used to raise capital from investors or to provide alternative means of settling transactions in financial instruments. The FCA’s Sandbox has supported projects testing the use of security tokens to raise capital efficiently.

He said: “An effective system of regulation of digital tokens has to allow the more promising use cases for the innovative technology that underlies the tokens to flourish – especially the potential to make payments and financial infrastructures more efficient and accessible.

“It’s essential to find the right balance between appropriate regulation to protect consumers and markets and encouraging useful new ideas in this space.”