A new report, by the FCA Practitioner Panel, has highlighted that the regulator has room for improvement in international regulation and Brexit.

The study, published yesterday, said the body had “made little or no progress in the area of international regulation over the last 12 months” and was found to be less “alert” to emerging EU issues than it was a year ago.

This comes despite recent speeches by senior FCA executives stating the the FCA was ready for Brexit and was “braced” for a no-deal outcome if it happened.

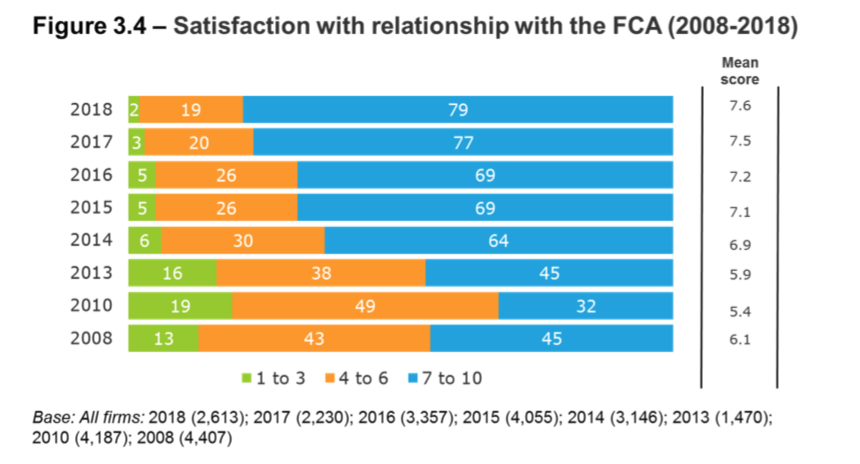

Despite the concerns over international issues, overall the report showed practitioners were slightly more satisfied with the FCA in general, from 7.5 to 7.6 out of 10 in terms of satisfaction ratings.

Satisfaction levels were slightly lower among fixed (larger) portfolio firms compared with flexible firms (7.3 compared with 7.6).

However, there was an increase in satisfaction levels among fixed portfolio firms from 6.9 in 2017.

The report concluded that: “Across the sectors there was little difference in levels of satisfaction with the relationship with the FCA.”

But in the international sphere the regulator suffered falling ratings.

Compared with 2017, both fixed and flexible portfolio firms were slightly less likely to agree that the FCA was sufficiently leading developments in international regulation.

Disagreement among fixed portfolio firms increased from 13% in 2017 to 15% this year.

A minority of all firms (28%) agreed that the FCA had been “alert” to emerging EU issues.

Just over a quarter of all firms (28%) agreed that the FCA was communicating with firms, to the extent that it can, on the process of preparing to exit the EU, with 16% saying they disagreed.

Half of all respondents said that they neither agreed or disagreed with this statement.

When firms were asked what the FCA should be doing ahead of the UK’s withdrawal from the EU, the most common responses were: “ensure clear and regular communication with firms” and “communicate the effect leaving the EU will have.”

FCA chief executive Andrew Bailey said: “Testing the effectiveness of the FCA’s work helps it to make better decisions and increase public value, and by listening to feedback it can learn for the future.

“The joint survey helps to provide feedback on the FCA’s work from across the industry, especially from the many smaller firms which do not have direct contact with the regulator.

“We were pleased that this year the response rate to the survey has increased from 21% to 26%.

“The more feedback we get, the more we can work together to make financial services work better for everyone.

“We were also pleased to see that the scores which we track for overall satisfaction and effectiveness have continued to increase, as they have done throughout the life of the FCA.

“Satisfaction has increased from 7.5 to 7.6 out of 10, and effectiveness from 7.0 to 7.1.

“The scores of the larger firms, which are traditionally lower than those of the smaller firms without direct supervision, have increased from 6.9 last year to 7.3 this year.”

Mr Bailey said the report had highlighted a number of areas where the FCA can improve, including facilitating innovation within UK financial services and transparency of regulation.

Anne Richards, chair of the FCA Practitioner Panel, said: “The FCA and the Panel will continue to work together to identify where the regulator is working well and where there is room for

improvement.

“Addressing the issues identified in this report will help the FCA to continue adapting to the rapidly changing external environment, to ensure the UK maintains its strong international reputation for regulation.”