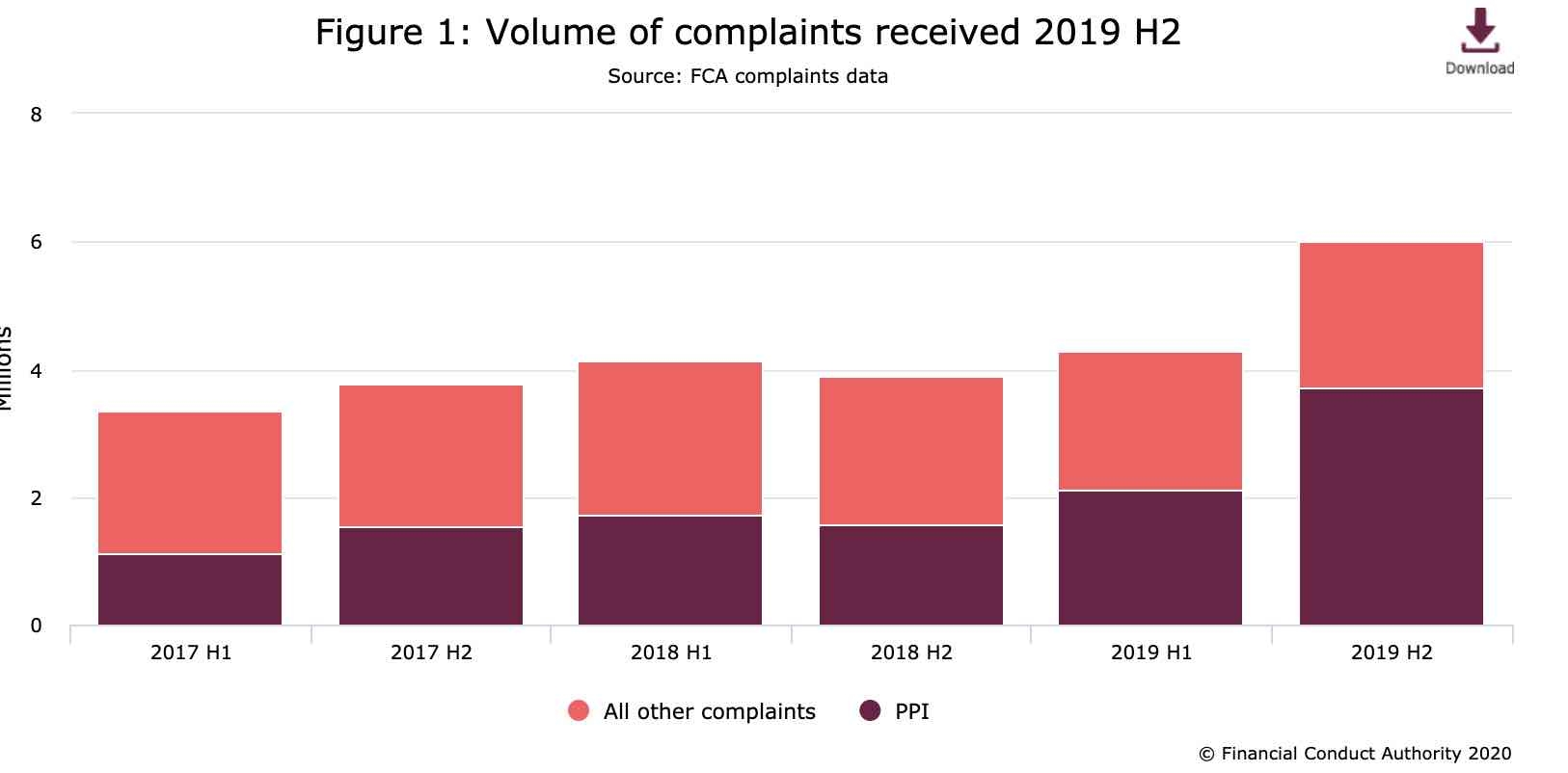

Complaints about regulated firms topped 6m in the second half of 2019, according to data published by the FCA today.

The number of complaints rose from 4.29m in the first half of 2019 to 6.02m in the second half of 2019.

The data reveals a rapid rise in the number of complaints over the past three years - with total complaint numbers close to doubling from the 3.34m seen in the second half of 2017.

The main driver of the latest increase was a 75% jump in the volume of PPI complaints from 2.12m to 3.71m however the volume of all complaints - excluding PPI - rose by 6% from 2.18m to 2.31m.

Excluding PPI, the most complained about products were current accounts (10% of all complaints), credit cards (6%) and other general insurance products (5%).

The number of complaints about decumulation and pensions held steady at 1.4 per 1,000 accounts in force but complaints about investments rose from 2.1 per 1,000 accounts in force to 2.3.

Overall decumulation, pensions and investment complaints formed only 2% of overall complaint numbers.

In terms of average redress paid, for investment complaints the average redress paid declined from £894 in the first half to £726 in the second half of 2019. For decumulation and pensions, however, average redress increased from £729 in the first half to £870 in the second half.

The number of complaints upheld for decumulation / pensions and investments declined. For investments it fell from 50.5% to 48% and for decumulation / pensions from 63.2% to 61.5%.

Investment products had the lowest ‘uphold’ rate compared to other product groups but decumulation and pension products had the highest of all product groups at over 60%.

PPI complaints formed 62% of all complaints received during the period with the figures suggesting a rush of complaints to beat the deadline of 29 August 2019, the FCA cut-off point for PPI complaints.

In terms of complaints against individual firms, on decumulation / pensions Prudential had the highest at 11,211 with Aviva not far behind on 11,025. St James’s Place Wealth Management had 343 complaints opened. St James’s Place UK (listed separately) had a further 650.

On investments, Barclays had most complaints opened at 5,673. Aviva was second with 5,001 complaints and Prudential third with 4,982. Hargreaves Lansdown was in fourth with 2,598 complaints opened. St James’s Place Wealth Management and St James’s Place UK plc had a combined total of 2,388 investment complaints opened.