Financial Planners look set to be stung by a 4.2 per cent increase in their FCA bill for next financial year.

The regulator said this morning it was proposing the rise for 2018/19 for the A13 fee block, which includes planners, advisers and other intermediaries.

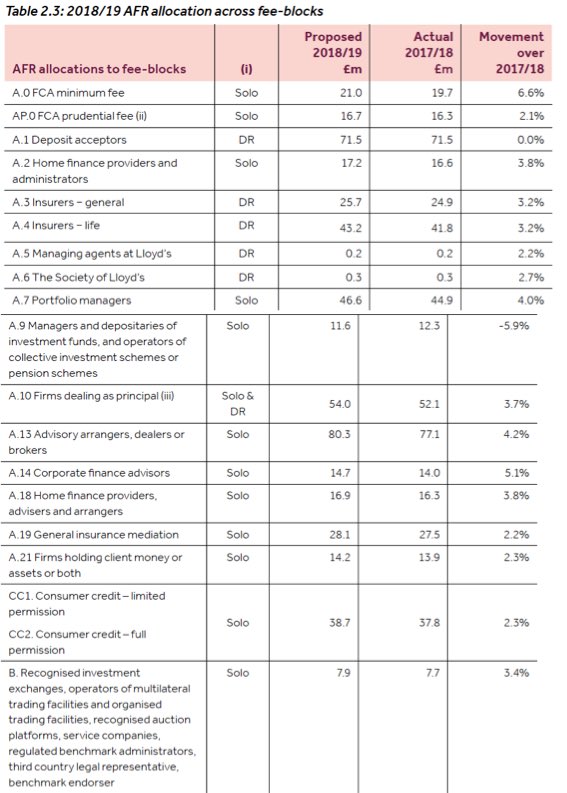

FCA has proposed increasing the A13 regulatory fees to £80.3m, after this group contributed £77.1m in in 2017/18.

Table above courtesy of the FCA: From the Business plan 2018/19

There will also be an increase in contributions towards the Money Advice Service for advisers. This will increase from £1.9m to £2.2m. The amount paid towards Pension Wise is planned to increase from £2.1m to £2.4m.

However, the FCA indicated advisers would not be paying a greater proportion of Pension Wise bills, saying that providers and investment companies would likely be beneficiaries from those taking advice after using the service.

The overall annual funding requirement will be £543.9million, the FCA said, equating to a rise of 3.2%. This has increased by £17m compared to last financial year. Officials attributed the increase mainly to costs associated with Brexit and areas such as Mifid II.

An £11m increase in costs for the FCA from Mifid II has partly been apportioned to the adviser fee block.

The FCA stated in the business plan document: “The A.13 fee block includes firms that provide financial advice who will only benefit if, after using Pension Wise, consumers seek advice from regulated financial advisers.

“However, firms in the other four fee-blocks will more likely benefit as the monies released through greater pension flexibility, if used for investment, will be distributed among them.”

The plan is up for consultation until the beginning of June.