The Financial Services Compensation Scheme (FSCS) has boosted the Temporary High Balance (THB) protection for deposits of up to £1m from six to 12 months for deposit-taker failures which take place from Thursday.

Data from today’s Wealth and Assets Survey from the Office of National Statistics has shown that the self-employed continue to invest in property over pensions for their retirement.

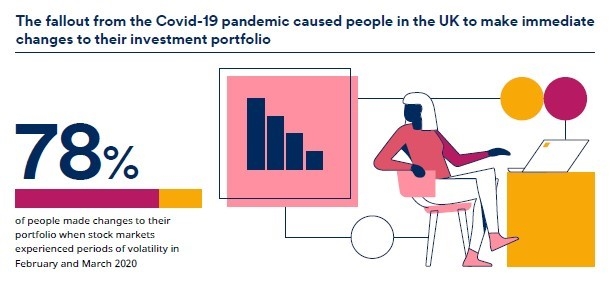

British investors expect average annual returns in excess of 11% over the next five years despite the uncertainty caused by the Coronavirus pandemic.

The average pension fund increased 13.3% in the second quarter of this year, the strongest quarterly performance since Q3 2009, according to new data.

Tilney has made its Sustainable MPS range available to the adviser market through its Tilney for Professionals arm.

The proposed six month notice period on property fund withdrawals could force investors into a longer term view of property funds. However, one Financial Planner warned of the potential inheritance tax implications

Three pensions and investments professionals have been nominated for lifelong peerages and are likely to join the House of Lords this year.

Only 27% of Britons would speak to a Financial Planner if they received £500,000, according to new research.

The Financial Conduct Authority may require property fund investors to give 180 days notice of withdrawal in future.

Crispin Odey, founding partner of Odey Asset Management, has been charged with indecent assault and is due to appear in court on 28 September at Westminster Magistrates Court.