Clifton Asset Management has acquired Plan For Life Wealth Management, the first in a series of “targeted acquisitions”.

The FCA is to host a series of events for British Steel Pension Scheme Members (BSPS).

The Pensions Regulator has revealed 39 firms have applied for master trust authorisation.

Adviser network Openwork’s asset manager Omnis Investments is to replace Woodford Investment Management as manager of its £330m Omnis Income & Growth Fund.

Tenet has selected Tatton Asset Management to run a managed portfolio service for its appointed representatives and directly authorised advisers.

Schroders new Financial Planning business - which began operations this week - may recruit more than the 700 planners originally envisaged.

A new book aimed at advisers has won praise from Financial Planning professionals.

Standard Life Aberdeen (SLA) is set to buy Grant Thornton’s Financial Planning and wealth management arm, according to reports.

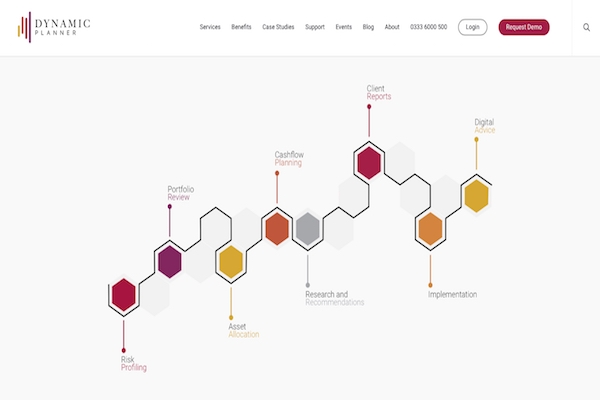

Dynamic Planner Elements has launched today to advice firms based across the UK.

Wealth management group St James’s Place has terminated its mandate with Woodford Investment Management.