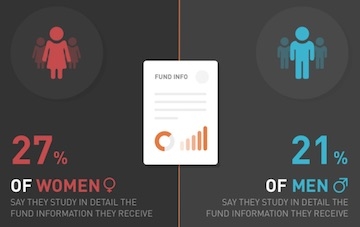

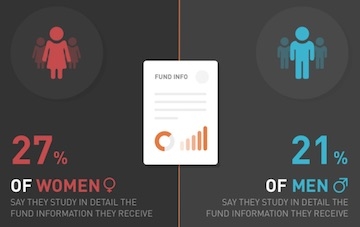

A graphic produced showing the survey results

The founder of a fintech firm says the FCA must radically overhaul how fund information is presented.

Majid Shabir, founder and chief executive of Instinct, has called for reform.

He made the comments as his firm’s research suggested women were more likely than men to read fund information in detail but fewer said they fully understand it.

Mr Shabir said: “With the FCA indicating that it is prepared to take action against firms that use jargon and asking the industry to look at communicating with their customer more simply, it’s surely time to review the way fund information is presented and overhaul it, radically.

“Using technology to filter information and provide contextual insight in a much more visual and intuitive way will allow fund managers to help both men and women make better investment decisions.”

His firm surveyed 500 retail investors to get their views on this subject.

Some 27% of the women said they studied the fund information they received in detail, compared to only 21% of men.

However, when asked if they fully understood the information, 19% of women indicated they did, compared to 25% of men. The work was carried out by fintech company Instinct Studios.

The research also found that wealthier investors (those with portfolios worth over £100,000) were least likely to study fund information, with 21% in that group doing so compared to 29% of those with portfolios in the £50,000-£99,999 range and 25% of those with portfolios under £50,000.

Mr Shabir said: “Our research adds to previous studies in the sector that show that there is a material difference between how men and woman absorb and act on financial information presented to them.

“It is difficult to say whether this is due differences in their respective appetites towards risk or familiarity with the financial terminology.

“Regardless of reasons, the fact that so few investors – both men and women, with large and small investment pots – are reading and understanding the fund information they receive, should ring alarm bells for advisers and fund managers.”