The FCA said that over one in 10 of the 106,000 contacts it received from consumers last year were to report a financial scam and ask what the next steps were.

The FCA said 11,650 (13% of the total) of the enquiries it received from consumers related to “possible investment frauds and other scams.” The FCA says it uses information collected from consumers as a valuable source of intelligence. It is also used to inform action against fraudulent and unauthorised activities including its ScamSmart campaign, enforcement action and collaboration with other anti-fraud agencies.

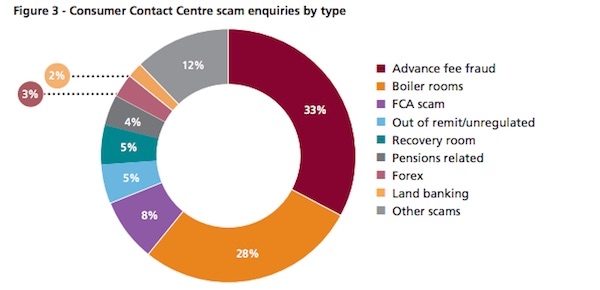

Over half of the scams were reported by over-55s. Among the biggest areas for scams was advance fee fraud (up 42% in the past year). This occurs where consumers, often younger, are charged advance fees to borrow money. Other major scam areas were boiler room fraud, fake FCA communication, unregulated investments, pensions, forex, land banking and recovery fraud (where scammers claim to be able to help consumers recover funds from previous fraud such as timeshare fraud).

The top three reasons why consumers contact the FCA are to check a firm’s status and regulation (36%), customer service (15%) and scams / financial crime (13%).

The statistics are featured in the regulator’s eighth data bulletin published today and covering the period December 2016 to November 2016. This edition focuses on insights from the Consumer Contact Centre, as well as the latest trends in the retirement income market.

The bulletin also looks at latest trends in the adviser market and says that number of pension pots being accessed for the first time fell from 157,039 in April to June 2016 to 145,068 in the period July to Sept 2016, suggesting a small cooling off in the number of people accessing their pension pots early.

The use of regulated advisers by consumers to seek advice on annuities is falling (33% of the total) and on a downward trend while the number seeking advice on drawdown is rising rapidly (65% of the total). Full withdrawal of pension has seen a significant increase in adviser use.

The bulletin is available from the FCA website.