One in three high risk pension transfers since July 2018 would satisfy the first condition of the Department of Work and Pensions’ (DWP) proposed scam reduction legislation, according to a new report.

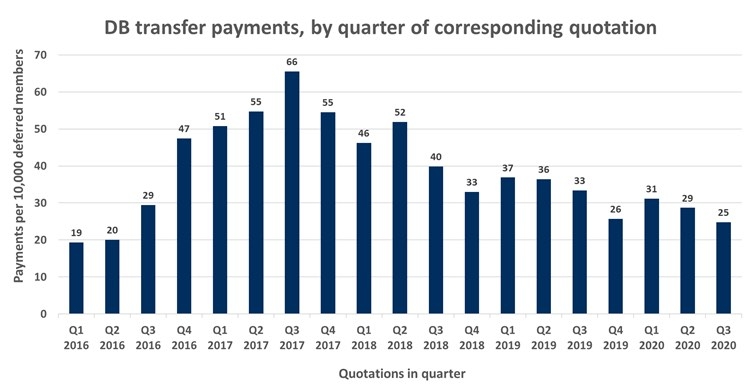

The number of DB transfer requests has fallen dramatically since the FCA introduced a ban on contingent charging last year, according to analysis from actuarial firm LCP.

The FCA has launched a major crackdown on scam bond and investment comparison websites in signs of a tougher approach from the regulator.

Ron Treherne IFA Ltd of Cardiff has had its permission to carry out regulated business removed by the FCA after it failed to pay Financial Ombudsman awards against it.

The FCA will seek to ban failed financial services firms from working with Claims Management Companies (CMCs) to target former clients.

The FCA has today launched plans for a new ‘Consumer Duty’ for regulated firms which will set a "higher level" of protection for consumers buying retail finance products and services.

The Financial Services Bill, which will help shape UK financial services regulation in the coming decades following Brexit, received Royal Assent yesterday (29 April).

Treasury minister John Glen today announced a £120m government-backed compensation scheme for LCF mini-bond victims which will pay up to 80% of losses up to a maximum of £68,000.

Most of the 11,500 former clients of failed wealth manager and DFM provider Reyker Securities plc have got their money back after intervention by the Financial Services Compensation Scheme.

The Competition and Markets Authority (CMA) has launched a new Digital Markets Unit (DMU) to tackle online competition.

Page 36 of 81