For many years, the law regarding UK tax residence has been largely subjective with the only definitive rule being that a person is resident in the UK if they spend more than 183 days in the UK in a tax year. However, proposed changes to the residency rules could affect the tax status of many individuals and have a knock-on effect on their companies or trusts.

Inheritance tax is a half-hearted tax, with many loopholes and opportunities for avoidance. This was the damning view of the Institute of Fiscal Studies Mirrlees Report, when assessing the current UK tax system.

Exchange Traded Funds and Exchange Traded Products have been in the news recently as a high profile court case involving synthetic ETF trading has emerged. Despite their promise of relatively low cost investment and suitability for long term investing, has the sector been tarnished by this bad publicity? Alexandre Houpert of ETF provider SG Lyxor looks at the recent concerns about ETFs and at how the sector is responding.

There is no doubt that the Retail Distribution Review has been forcing individual platforms to take a close look at what they will offer the fee-based advice market come 2013.

Retired couple Michael, aged 76, and Margaret, 74 from Dorset approached me due to concerns about their shortfall in income coupled with an increase in living expenses. They had saved all their lives and were quite cautious by nature, so to see their expenditure exceeding their income each month to the tune of £300 was incredibly worrying for them.

The Sipps market has been through several years of expansion and continues to grow but will tighter regulation, tougher competition and squeezed margins take their toll?

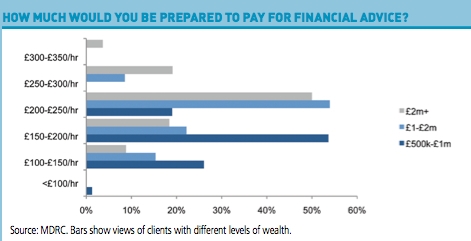

In the current economic climate it is a brave man who will commit his thoughts on the prospects for UK wealth and the wealth management sector. However despite the turmoil in the markets, we at MDRC have published our 13th annual review of the HNW sector and, if we take a step back from the current uncertainties, we are broadly optimistic for the prospects for UK HNW and the wealth management sector. We also see potential for Financial Planners offering holistic advice to do well.

Duncan (aged 56) and Rebecca (53) came to Penguin Wealth Management with one burning question - could they afford to retire? Duncan had just accepted voluntary redundancy after working for his company for over 30 years. Rebecca was keen to give up her part time job, which she was not enjoying.

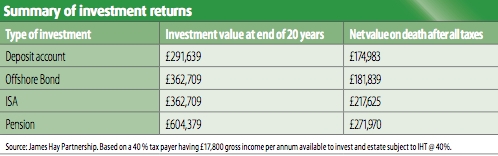

Why a 55 per cent tax charge is far from the death knell for pension planning despite the claims of some concerned retirement advice experts, by Neil MacGillivray from James Hay Partnership.

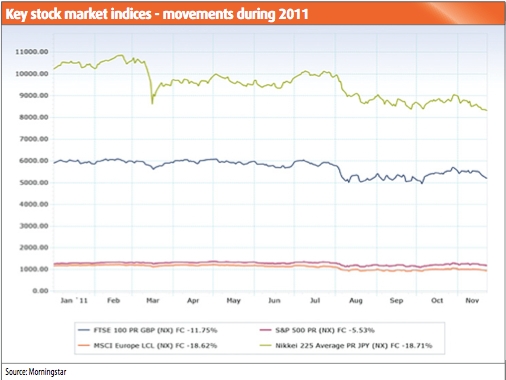

The economic gloom may be masking some significant investment opportunities during the UK's Olympic year. Sally Hamilton talks to some leading planners and other experts about what lies ahead.