Nearly three in 10 (28%) of over-60s with over £200,000 in investable assets or household income have failed to ring-fence money to fund later life care they may need, a new report says.

The top fixed savings rates have seen significant falls over the past month, according to a new report.

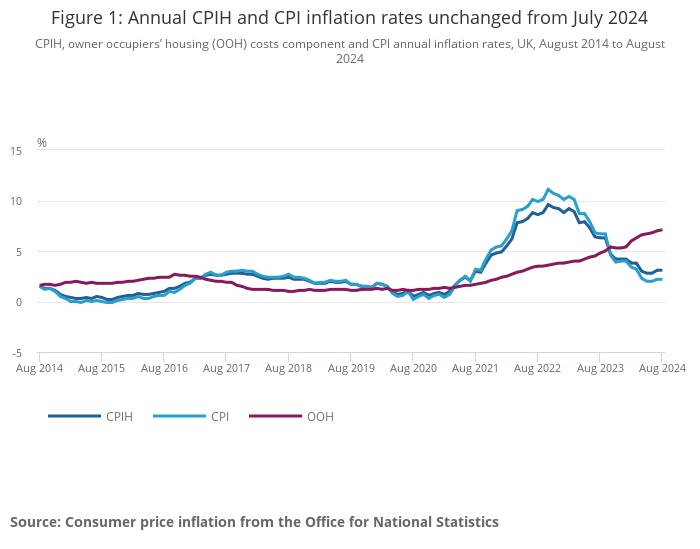

CPI inflation remained at 2.2% in August, unchanged from the previous month.

Fast-growing Financial Planning and wealth management group Loyal North has completed two more acquisitions in Hertford and Essex, adding £56m in AUM.

Clients are turning to multi-asset investment strategies to help them cope with their financial fears in retirement, according to a new provider survey of advisers.

Acquisitive South Coast-based wealth manager Skerritts has acquired £1bn AUM Harrogate advice firm Ellis Bates Financial Advisers for an undisclosed amount.

Professional advisers' review site VouchedFor has joined forces with global asset manager BlackRock and adviser investment platform Fundment to launch a 2025 Guide to Top Rated Financial Advisers.

Wealth manager and Financial Planner Brooks Macdonald has acquired Norwich-based Lucas Fettes Financial Planning for an undisclosed amount.

Fintech and adviser support services firm Fintel, owner of SimplyBiz and Defaqto, said profits climbed 7% to £9.6m in the six months to the end of June.

Dubai-based wealth manager and Financial Planner GSB has recruited Paul Waterman and Craig Holding to join its GSB Wealth division.